How we Calculate Labour Costs in Propared

Greetings! Calculating labour costs can be complicated. We understand that there are many things that go into these calculations based on a whole host of different pay rules. Our goal with this article is to explain how Propared calculates hours and costs and to provide some concrete examples.

What is the purpose of calculating Labour costs in Propared?

The purpose of calculating crew and Labour costs in Propared is to assist the manager in more accurately forecasting the costs and implications of scheduling people across their organization and projects. The numbers we calculate are not intended to reflect all pay scenarios, specific local state and federal laws, or any other applicable regulations. It is up to you to research your local laws and requirements and ensure your compliance with them when paying your employees and contractors.

Once you have your estimates, if you need to then prep this information further for payroll, you can download your raw data by going to the Timeline > Crew Bookings screen and selecting Export from the more menu.

Why is Calculating Labour Costs so hard?

There are often multiple overtime calculations involved including overtime and doubletime per call as well as weekly overtime hours for a person.

Calculations become more complicated when both daily and weekly overtime apply to the same person on a call.

Additional complications occur because it is possible for someone to also work on different projects and at different pay rates within a single work week.

These scenarios can have a drastic impact on the potential costs associated with scheduling labour. So we’ve designed Propared to help calculate hours worked and cost estimates in these complicated scenarios.

References

To help guide us, we reference the United States Federal and State Laws for calculating overtime for both Weekly and Daily hours worked:

The United States Fair Labor Standards Act (29 U.S.C. § 207) sets up a requirement for calculating overtime based on the number of hours an employee works in a week.

Under the applicable section of the Fair Labor Standards Act (29 U.S.C. § 207), employers are required to pay overtime to all non-exempt employee overtime compensation for work performed in excess of forty hours per week.

States often have additional requirements for calculating overtime based on the number of hours an employee works in a day as well as per week. For example:

In California Labor Code section 510, there are two forms of overtime: (1) daily overtime and (2) weekly overtime.

When an employee works only in excess of the weekly or the daily number of straight-time hours, the overtime hours are simply the number of excess hours worked. Thus, for example if an employee works only a single day of ten hours in a workweek, the employee is owed eight hours straight-time pay and two hours of overtime pay for the workweek. Similarly, an employee who works six eight-hour days in a workweek for a total of 48 hours must be paid 40 hours at straight-time pay and eight hours of the applicable overtime rate. (Wage and Hour Manual for Cal. Employers, (4th ed. 1988) § 8.15(a), pp. 272-273.))

Daily and Weekly Overtime Combinations

Why we don't Pyramid Overtime

There is also a scenario where an employee incurs daily overtime and weekly overtime on the same week. Propared only uses regular hours worked to calculate the threshold for weekly overtime. Any hours worked in a day that are paid at overtime rates do not count towards determining when weekly overtime begins. This is called “pyramiding overtime” and can lead to overtime being counted towards further overtime.

California courts have held that an employer is not required to combine more than one rate of overtime compensation to determine the amount to be paid for any hour of overtime work. DeYoung v. City of San Diego (1983) 147 Cal.App.3d 11, 18-19; Koebke v. Benardo Heights Country Club (2005) 36 Cal.4th 824, 840.; People v. Giordano (2007) 42 Cal.4th 644, 659.

In Monzon v. Schaefer Ambulance Service, Inc. (1990) 224 Cal.App.3d 16, the court discussed whether pyramiding overtime compensation is permitted under Industrial Welfare Commission wage orders relating to overtime compensation. The issue was how to calculate overtime when an employee worked both more than 8 hours in a day and more than 40 hours in a week. The Court reached the same result as the Legislature required in Labor Code section 510, holding that “the proper method to use in calculating overtime is one in which the employer must identify at week’s end all hours worked by an employee during that workweek and pay overtime based upon the excess of total hours over the greater of either: (1) eight hours in a workday, including double time, or (2) forty hours in a workweek.” Id.

For example, if an employee is scheduled for 6 10-hour days, then the first 5 days will each be calculated at 8 regular hours and 2 daily overtime hours. On their 6th day of work, their regular hours will have exceeded 40 so the day will be calculated at 8 weekly overtime hours and 2 daily overtime hours.

How to setup Propared to calculate hours and costs?

First, you’ll want to establish these settings for your organization in the Settings Screen > Preferences Tab:

Work Week Settings

- Work Week Start Day:

- Establish the day of the week that your work week starts on. We default to a Monday -Sunday work week.

- Weekly Overtime Threshold:

- This is the hour after which we begin calculating weekly overtime for any additional regular hours worked. We default to weekly overtime starting after 40 regular hours in a work week.

- Weekly Overtime Multiplier:

- This is the overtime multiplier for any weekly overtime hours. The default multiplier is 1.5 times the regular rate.

Labour Cost Rulesets

Next, you can set up multiple Labour Cost Calculation Rulesets which can be applied to the various crew positions that you will be creating. This is where you’ll establish overtime rules that apply to a specific event.

- Overtime 1 Multiplier:

- This is the overtime multiplier for any overtime 1 hours. The default multiplier is 1.5 times the regular rate.

- Overtime 1 Threshold:

- This is the hour during an event after which overtime 1 starts. The default is Overtime 1 starts after 8 hours in a call.

- Overtime 2 Multiplier:

- This is the overtime multiplier for any Overtime 2 hours. If you calculate double time you can set this multiplier to 2 times the regular rate.

- Overtime 2 Threshold:

- This is the hour during a call after which overtime 2 starts. This number must be greater than the Overtime 1 Threshold. For example, you could set up a scenario where Overtime 1 starts after 8 hours and gets a 1.5 multiplier and Overtime 2 starts after 12 hours and gets a 2 multiplier (reflecting Double-time).

Positions

Once these settings are established, we can now create our Positions. For each Position, we can set a default pay rate and a Labour Cost Ruleset.

Once you have set these values, you’ll see a section that shows you all of your different overtime rates.

Labour Lines

Now we have everything that we need to begin estimating labour. As you create new events in the timeline, you can add labour lines. Labour Lines are objects that allow you to quickly populate your crew needs for an event prior to knowing exactly who will be working. When you create a labour line you’ll identify a position and the quantity of that position needed for the event. For example, a Load In Day may require 3 stagehands and 5 electricians.

Using this information, Propared can immediately build a rough labour budget for you by using the duration of the event, position pay rate, and the labour cost ruleset to calculate any OT1 and OT2 costs. However, since we don’t know who is working each call, we can’t yet identify any weekly OT costs.

Crew Bookings

In order to get a more accurate cost estimate, we’ll need to start assigning people to the crew positions that we set in the Labour Lines. Once that is done, Propared can begin tracking a person’s hours worked across different crew bookings a work week. This may include multiple crew bookings for that person across multiple projects and positions with different pay rates.

Computation Example

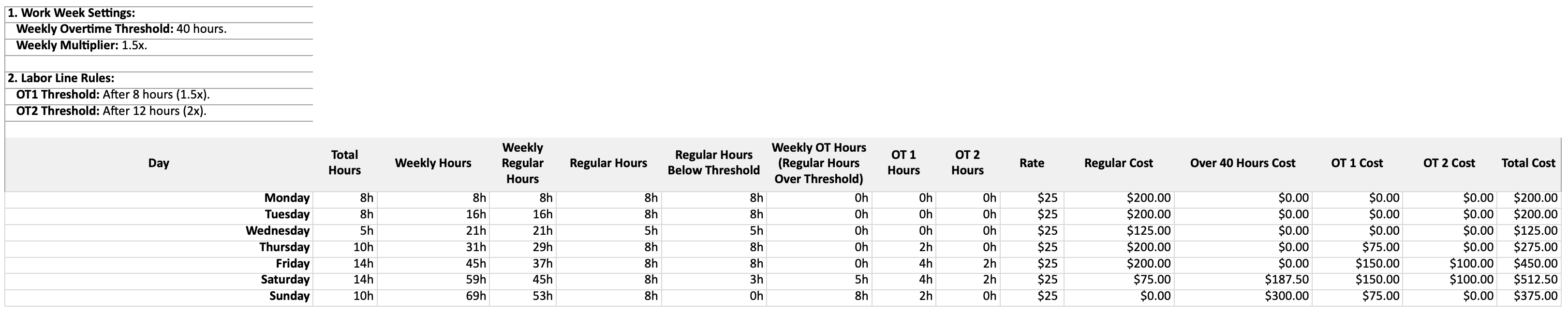

Below is a table showing our hypothetical employees work hours.

For this scenario our Settings Setup is as follows

- Our Company’s workweek start on Monday and ends on Sunday. They calculate Weekly overtime as 1.5 times regular pay after 40 hours in a work week.

- This employee’s position has an associated Labour Cost Ruleset:

- OT 1: 1.5 times regular rate starting after 8 hours in a labour line.

- OT 2: 2 times regular rate starting after 12 hours in a labour line

- For this example they work the same pay rate for all days of work.

We follow a 4-step process for computing the employees’s correct estimated hours and costs.

- First we calculate the employees daily regular and overtime hours using the Labour Cost Calculation Rulesets you have applied to the position. We use the pay rates associated with the position to estimate the costs of that day’s work.

- Example: For Monday this employee works 8 hours at the pay rate of 25$ an hour. No OT 1 or OT 2 is calculated as they are under the Labour Cost Ruleset threshold of 8 hours.

- They are also scheduled for 8 hours on Tuesday and 5 hours on Wednesday. On Thursday however they are scheduled for 10 hours which means that after 8 of those hours Propared begins to use the Labour Cost Ruleset for OT 1 to adjust the pay rate from 25$ per hour (base pay) to $37.50 per hour (1.5 times regular pay) for the last 2 hours (hours 9 & 10).

- Friday has them scheduled for 14 hours, which means they will trigger OT 1 and OT 2 calculations. 8 hours at 25$ per hour (base pay) 4 hours at $37.50 per hour (1.5 times regular pay for hours 9-12) and $50 per hour (2 times regular pay for hours 13-14)

- Next we tally up the total weekly regular time hours worked within the set work week period.

- At the same time the daily calculations are taking place we are also tallying weekly hours. For Monday, Tuesday and Wednesday their total weekly regular hours is 24 hours. After Thursday their weekly regular hours is 30 hours. (see above for why we do not pyramid over time hours)

- We identify if during a specific call that employee has reached the weekly OT threshold. If the employee reaches that weekly threshold during that call and all additional calls in that work week we calculate the additional hours at the Weekly OT rate using the pay rate for the position for those calls.

- On Saturday our staff member hits the threshold of going over 40 hours of regular time in the week. This means that in addition to the daily overtime calculations all the rest of the regular time for this week is now calculated at the weekly OT rate of 1.5 times regular pay.

- Then we tally up all of these to estimate the total daily and weekly costs. 1.

What can you do with this information?

When you are booking crew or figuring out the schedule for different labour needs you can more easily see the cost implications of working someone long hours during a day or week. Later in the week an employees time may become a lot more expensive to you as the employer and can become a surprise expense when payroll is run.

You can better plan for these costs, or decide to bring on additional staff instead. This is especially helpful if different people are booking crew for different calls on different projects. It allows the organization as a whole to see how they are using their crew across projects and the implications of working the same people over and over. It also makes over-work more visible to the management team and allows you to proactively plan for a more sustainable work life balance for your staff.